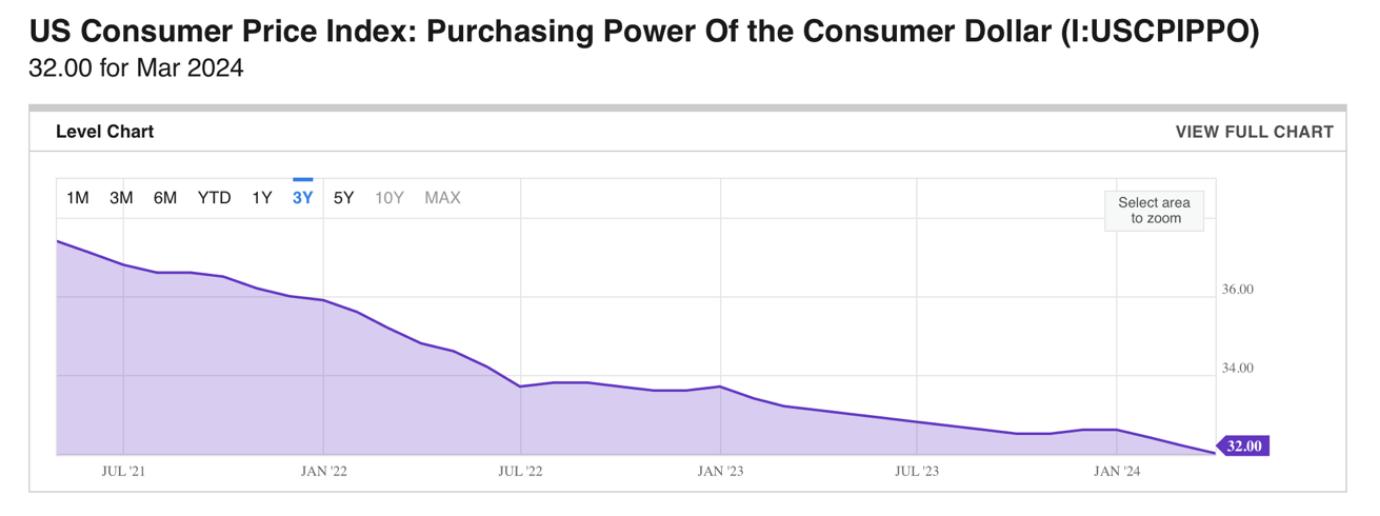

Change in Purchasing Power

Inflation is a major issue in the US, and it’s critical to understand its effect on US consumers at a macro level. In a real sense, inflation erodes purchasing power, as the same dollar buys less. In the chart below, real purchasing power of the US dollar over the last three years is detailed showing a decrease of over 16% since March of 2021. The index below is based on data going back to 1984 and shows the clear erosion the US dollar’s purchasing power, due to the net effect of inflation on goods and services.

Since the COVID relief dollars stoked the US economy in 2020, the consumer hasn’t felt all of that pinch, as real wage growth has offset much of the decrease. But over the last 12 months, wage growth is decelerating as the graph below shows. When salary growth slows and dollar purchasing power decreases at the same time, most consumers must “trade down” what they consume. A “trade down” is when a choice is made on price concessions alone. The premium brand is abandoned for the generic, extras are sacrificed for lower prices and the “new car” shopper will settle for “lightly used.” Evidence of this effect is everywhere in the economic data recently released and is easy to see when driving by new car lots. Subscription services which have plans priced at multiple levels are seeing attrition at the higher price points, particularly among lower wage earners who are overleveraged.

Every brand needs to stay abreast of these macro economic trends and adjust their growth plan to meet them. Ask questions like these to identify new areas of revenue:

Which brand or vertical is priced at a premium to your brand?

If new sales are slow, do you have a service department or refurbishing service?

Can you stomach a discount strategy to maintain your customer base?

Are your marketing and sales strategies aligned to onboard customers into plans and subscriptions that fit their needs? (Often sales plans place consumers in the highest plan due to incentives when the consumer needs something less expensive).

Every brand has its own unique set of challenges and opportunities as it faces the second half of 2024 and the Trade Down Effect. The key to meeting these challenges is understanding how the effect has impacted your brand’s customer segments and to then create value propositions to capture lost revenue, win back lost customers and even create new products and services to build your bottom line.

Stop guessing and start Knowing with blu.

In an ever changing marketing landscape, one thing remains paramount: being able to identify customers is the most basic requirement for direct marketing. Customer-obsessed marketers need to leverage the power of online identity resolution starting now. Marketing spend needs to be stewarded at the highest levels, because not knowing who you are marketing to is no longer an option. It’s time to stop guessing and start KNOWING. At blu, we give marketers the power to find (and get to know) the right people in the right places at the right times. We provide the vision and insight you need to identify your best customers; to target the people most likely to be impacted; and then focus on the best ways to be seen, heard, and understood by the people who matter most — YOUR CUSTOMERS.

Chad Stubbs

Driven by a passion to connect people with innovation and excellence, Chad Stubbs launched Reflex Blu in 1999. His “creatalytical” vision of leveraging creative and analytic excellence is at the heart of blu’s continuously innovative culture. Chad has been the strategic lead on countless brands over the past 20 years, and he still gets a thrill out of building profitable customer journeys for the brands we serve at blu.